2011

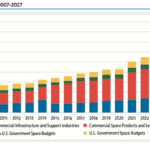

Global space activity by category, 2007-2027

The global space economy totaled $546 billion in 2022, 8% higher than 2021 — and it could reach $772 billion by 2027, according to Space Foundation analysis. Commercial space continues to make up the majority (78%) of this total, but preliminary data shows that 81% of governments with space programs increased spending in 2023.

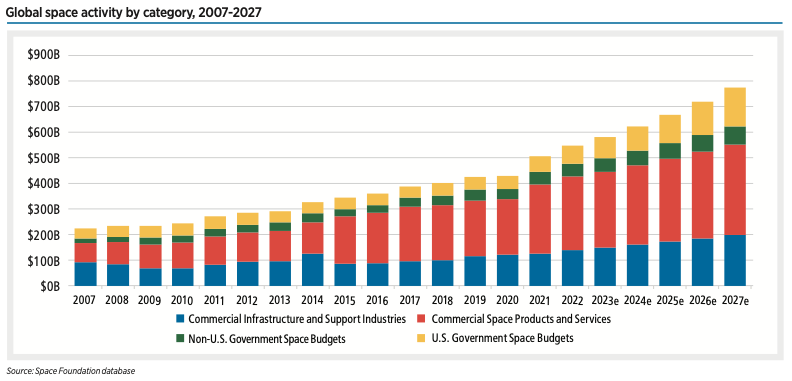

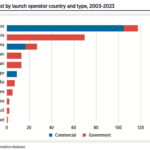

Launch failures by number of satellites lost, 2003-2023

In 2023, launch failures resulted in the loss of 31 satellites, an increase of 48% from 2022.

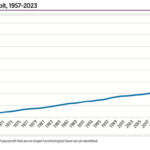

Cumulative spacecraft on orbit, 1957-2023

Federal agencies in 2014 estimated by 2022 as many as 43 commercial satellites a year would head to orbit. Instead, more than 50 times . . .

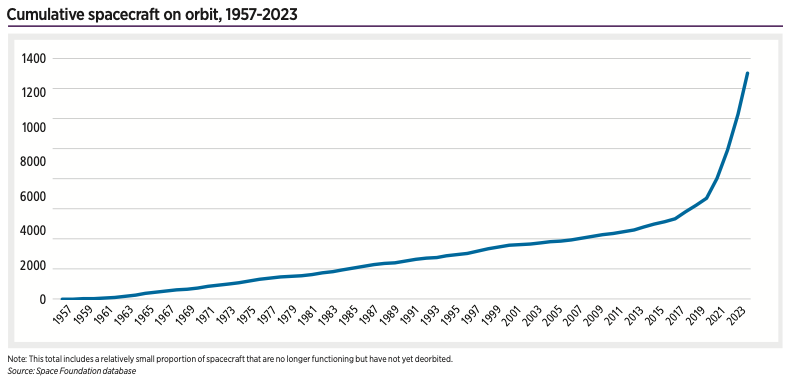

Space insurance industry estimates, 2003-2022

As satellites get smaller and cheaper and companies pivot to building LEO constellations rather than purchasing single large satellites for GEO orbit, many operators are foregoing insurance after launch altogether.

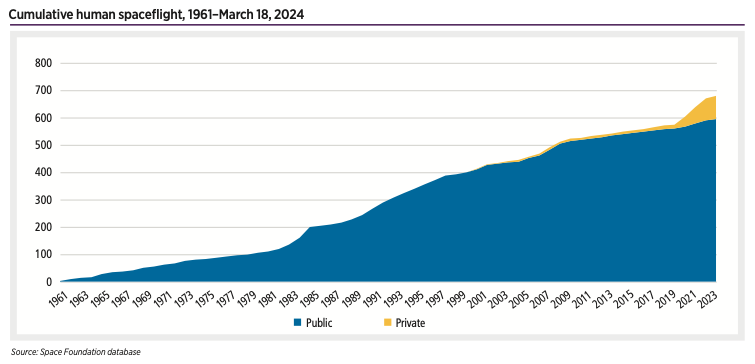

Cumulative human spaceflight, 1961–March 18, 2024

Human spaceflight activity is off to a rapid pace in 2024 with a private Axiom mission, a public ISS mission, and a private Virgin Galactic mission taking flight in the first nine weeks of the year.

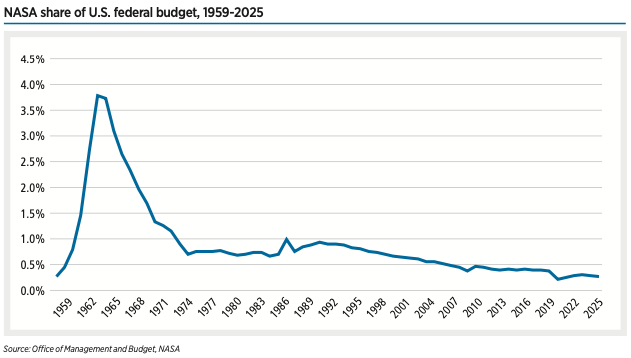

NASA share of U.S. federal budget, 1959-2025

The overall Pentagon budget proposal for 2025 is $850 billion, $8 billion more than its 2024 request.

Satellites lost by launch operator country and type, 2003-2023

Despite the rising number of lost payloads, satellite operators are getting better at mitigating the harm done to their mission by a launch failure.

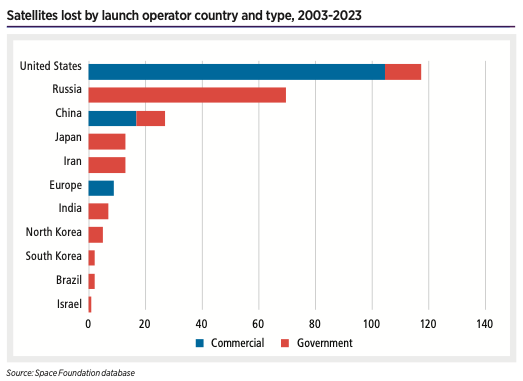

Launch Attempts and Deployed Payloads, 1983-2022

Two items stand out as primary examples of astronomers’ concerns: the SpaceX Starlink constellation due to its number of satellites and AST SpaceMobile’s BlueWalker 3 satellite due to its size — 693 square feet6 — which ranks as the largest commercial communications array in space.

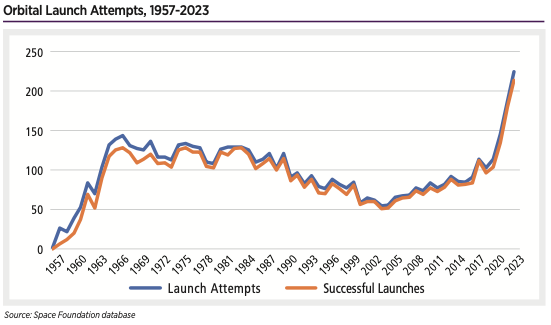

Orbital Launch Attempts, 1957-2023

The number of U.S. launch at- tempts climbed from 87 in 2022 to 116 last year. The number of U.S. launches has more than doubled since 2021, which saw 51 launch attempts.

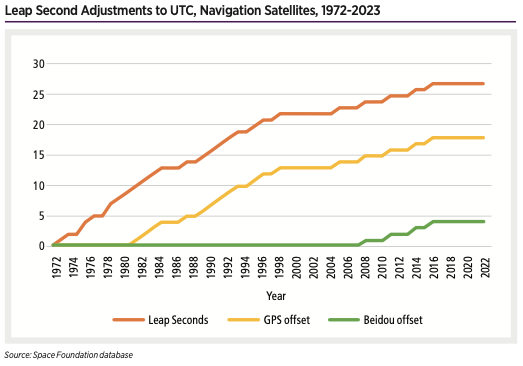

Leap Second Adjustments to UTC, Navigation Satellites, 1972-2023

But every technological leap in clock accuracy can’t overcome the wobbly planet’s ability to throw off timing standards. Using leap seconds, the International Bureau of Weights and Measures has changed clocks to match the astronomical time on Earth 27 times.