Luxembourg

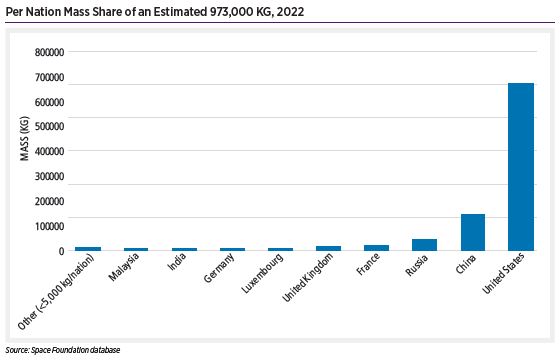

Per Nation Mass Share of an Estimated 973,000 KG, 2022

Operators deployed ~421 spacecraft with a mass of 200 kg or less, 18% of all deployed spacecraft in 2022. SpaceX’s Starlink satellites comprised over half the spacecraft mass deployed in 2022. The company’s Starlink deployments added up to 518,523 kg, nearly double the 257,140 kg it deployed in 2021. The largest spacecraft deployed during 2022 was Lockheed Martin’s Orion space capsule (25,848 kg), deployed during NASA’s first Artemis/Space Launch System launch.

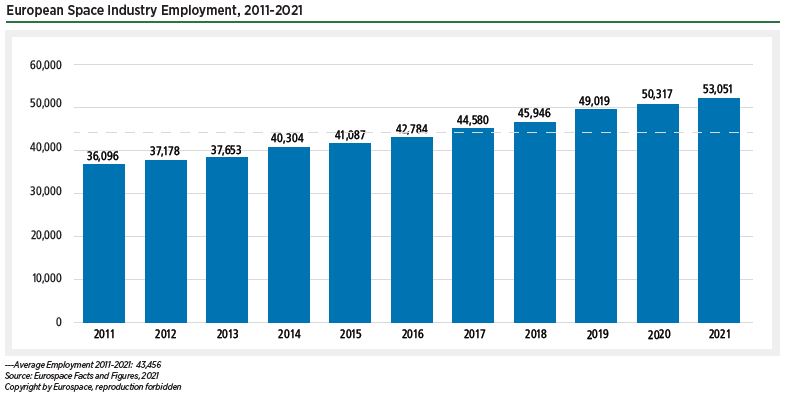

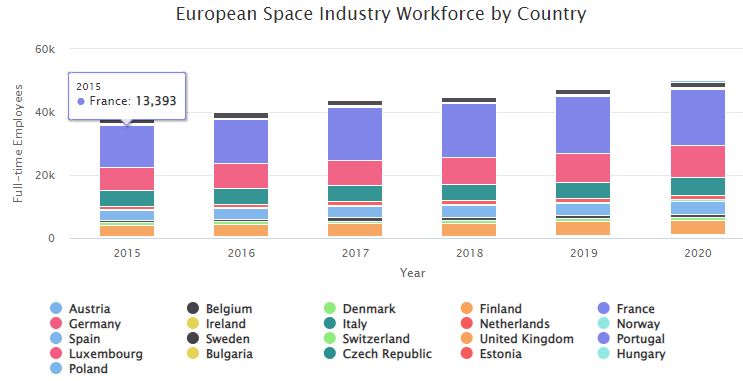

European Space Industry Employment, 2011-2021

European space employment was 53,051 in 2021, an increase of 5.4% from the total of 50,317 from 2020. This estimate is based on analysis by Eurospace, the trade association of the European Space Industry. The analysis focuses on the space manufacturing industry; space services companies such as Ariane- space, SES, Eutelsat, and Inmarsat which also employ thousands of individuals, are not included.

Europe Continues to Lead in Global Workforce Job Growth

The space industry relies on skilled individuals from a wide variety of fields to enable the cutting-edge developments taking place in this sector. While many countries do not regularly produce metrics on the size of their workforce, these data are available for several major space actors, including the United States, Europe, Japan, and India.

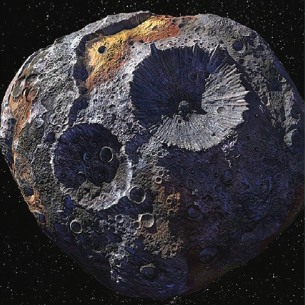

Asteroid Mining: Potential Develops, but so do Regulatory, Technical Issues

Mankind could soon be able to exploit asteroids to obtain natural resources for use on Earth, gather ingredients for missions in space, and support habitation on the Moon and Mars.

2019 TSRQ4 – Space Policy

In 2018, significant policy developments helped shape the future space economy. At the international level, the United Nations Committee on the Peaceful Uses of Outer Space (COPUOS) released its . . .

2019 TSRQ3 – Education STEM Proficiency

The science, technology, engineering, and mathematics (STEM) workforce is at the core of the space industry—from the mathematicians and astronomers who analyze space to the engineers who design and build the launch vehicles that get us there. This workforce is enabled . . .

2019 TSRQ1 – Infrastructure: Spacecraft Overview

As of March 6, 2019, information was available about 38 nations that deployed and operated 465 spacecraft during 2018. The number of nations operating spacecraft grew 10% from 2017 to 2018, with 75 total nations operating spacecraft. While . . .

2018 – Communications Satellites Mission Segment Breakdown – Snapshot

The majority of communications satellites deployed in 2018, 66% (85), were for commercial purposes. Civil government missions ranked . . .

European Space Industry Workforce by Country 2000 – 2020

Stacked bar chart showing a twenty-year look at the European space industry workforce by country 2000 – 2020

2014 – Military Communications

Global, dedicated, and secure communications networks are vital to governments, militaries, and agencies around the world. Increased demand for capacity—particularly secure connectivity using non-commercial frequency bands—continued to drive deployment of dedicated military communications satellite systems. The U.S. military bought significant capacity from commercial operators such as Intelsat and SES in 2014. However, the way the military buys the bandwidth has been criticized by commercial satellite communications services as expensive and outdated.