Japan

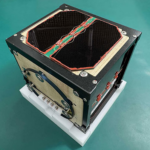

Japan completes world’s first wooden satellite

A Japanese university and lumber company are working together to send the first wooden satellite to the International Space station later this year.

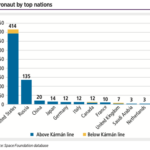

Astronauts by top nations

The majority of astronauts (95%) have also reached the Kármán line at 100 km — the internationally recognized boundary of space.

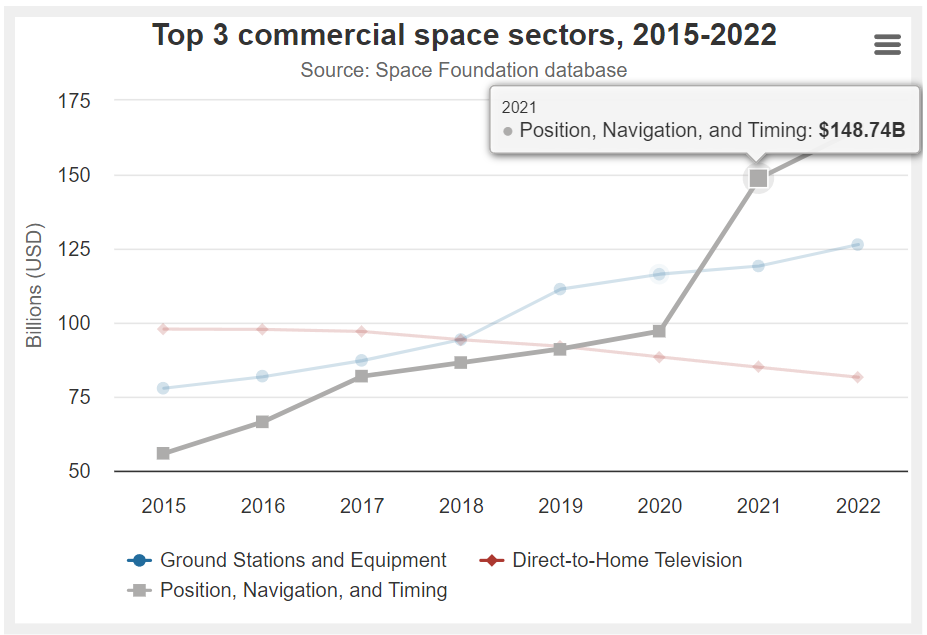

SNAPSHOT: Global space economy

The global space economy totaled $546 billion in 2022, 8% higher than 2021 — and it could reach $772 billion by 2027, according to Space Foundation analysis.

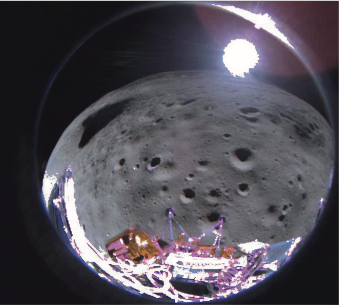

2020s is the busiest decade for Moon landings in 50 years

In the span of six months from 2023 to 2024, three countries landed spacecraft on the Moon, and many more are in the works.

Space-based research brings billions in value to medicine

Every year, NASA turns $10 billion in research and development funding into roughly 1,000 technology reports and 100 new patents.

Liftoff: Q1 2024 Highlights

The space industry is advancing faster than ever before with continual progress in the government, military and private sectors. Here are noteworthy business highlights from this quarter.

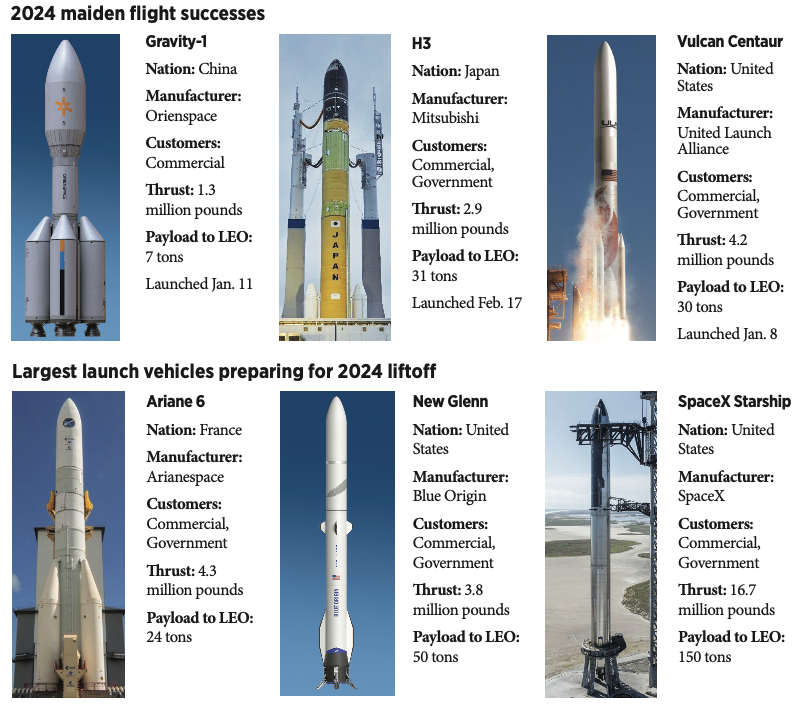

SNAPSHOT: New launch vehicles

The launches included successful maiden flights for three new launch vehicles. With a dozen more new launch vehicles expected to debut, 2024 appears poised to be a game-changing year in orbital flight.

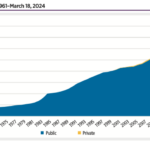

SNAPSHOT: Human spaceflight

As of mid-March, 685 astronauts have reached at least 80 kilometers above the Earth’s surface. This total includes 86 private astronauts, 22 times as many as there were two decades ago.

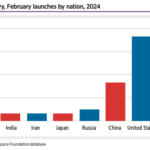

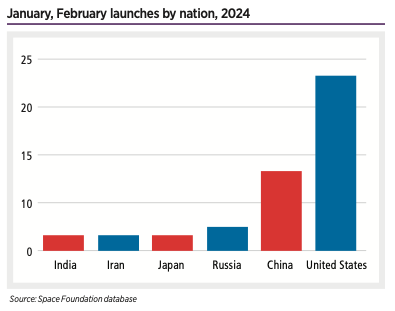

January, February launches by nation, 2024

January, February launches in 2024 put the planet in line for the busiest year in space, averaging a launch to space every 32 hours.

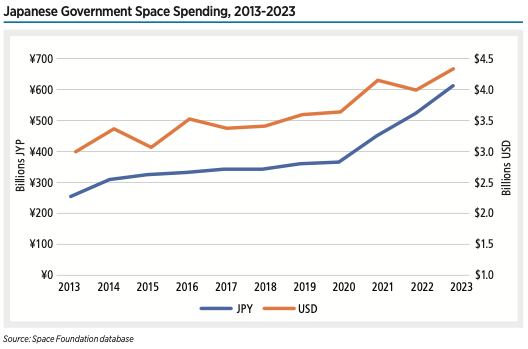

Japanese Government Space Spending, 2013-2023

Japan’s space spending spans seven ministries and totaled ¥612 billion (UD$4.3 billion) in 2023. This budget has grown 68% since 2020 as the nation expands its civil and military space programs. The Ministry of Education, Culture, Sports, Science, and Technology (MEXT) — which houses JAXA — typically receives the majority of space-related funding.