2015

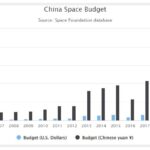

Chinese Space Budget, 2005-2021

The Chinese space budget is not publicly available. However, Chinese capabilities and space projects provide indicators for informed estimates of the nation’s space budget. . .

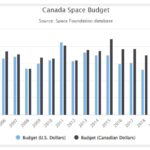

Canadian Space Budget, 2005-2021

The Canadian government allocates money to the Canadian Space Agency (CSA). Canada is also a cooperating state with the European Space Agency (ESA).

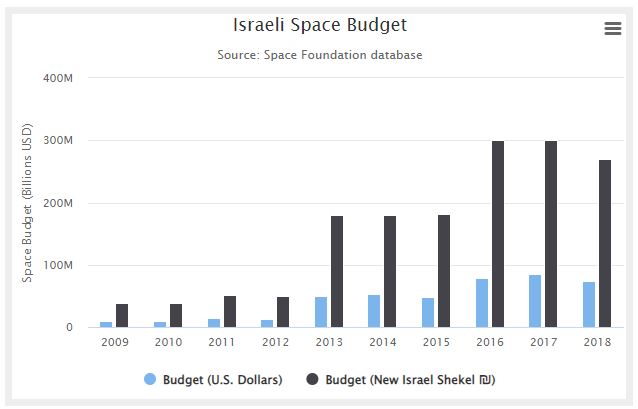

Israeli Space Budget, 2009-2018

This interactive chart shows changes made in the accompanying table. Use the tools just above the table for sorting, advanced filtering, and other options, these actions will reflect on the…

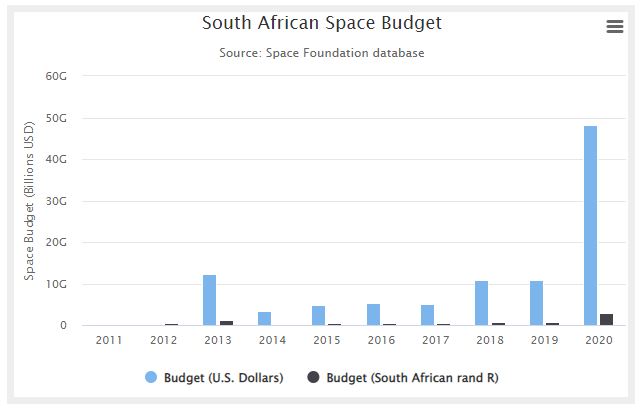

This interactive chart shows changes made in the accompanying table. Use the tools just above the table for sorting, advanced filtering, and other options, these actions will reflect on the… South African Space Budget, 2011-2020

This interactive chart shows changes made in the accompanying table. Use the tools just above the table for sorting, advanced filtering, and other options, these actions will reflect on the…

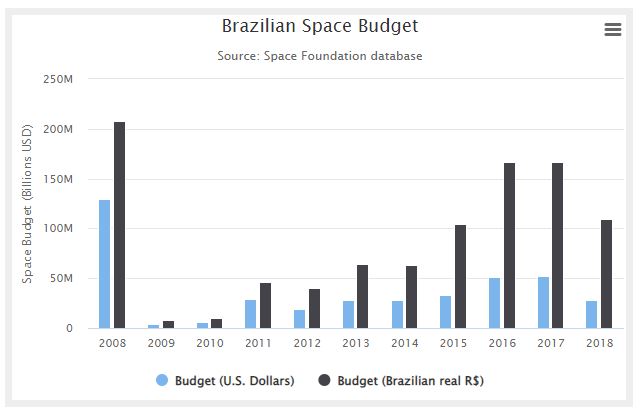

This interactive chart shows changes made in the accompanying table. Use the tools just above the table for sorting, advanced filtering, and other options, these actions will reflect on the… Brazilian Space Budget, 2008-2018

This interactive chart shows changes made in the accompanying table. Use the tools just above the table for sorting, advanced filtering, and other options, these actions will reflect on the…

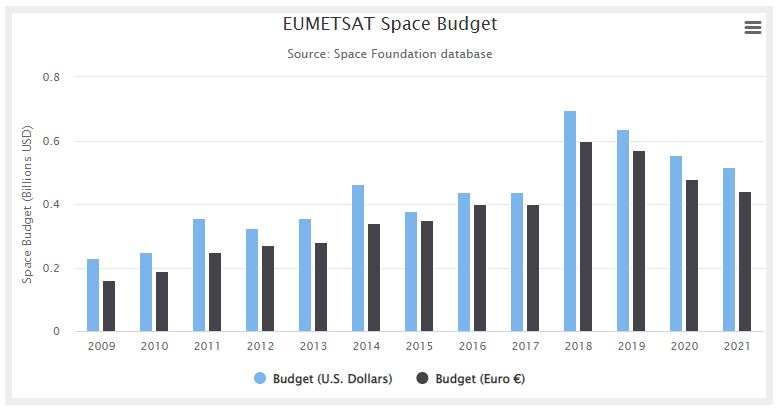

This interactive chart shows changes made in the accompanying table. Use the tools just above the table for sorting, advanced filtering, and other options, these actions will reflect on the… EUMETSAT Space Budget, 2009-2021

Civil government spending on space programs and activities in Europe comes from four sources . . .

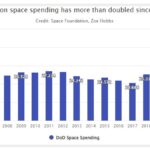

Pentagon space spending has more than doubled since 2005

Space Foundation records show Pentagon space spending has more than doubled since 2005 from $19.7 billion to $41.4 billion

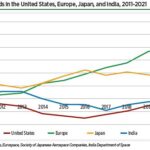

Space Workforce Trends in the United States, Europe, Japan, and India, 2011-2021

The U.S. space sector is composed of more than 198,500 individuals across private sector and government organizations. Private sector space employment continued a trend of growth that began in 2016, adding approximately 3,000 new workers from 2020 to 2021 to reach 151,797 individuals. Space manufacturing led this growth, offsetting a slight decrease in the size of the satellite telecommunications workforce.

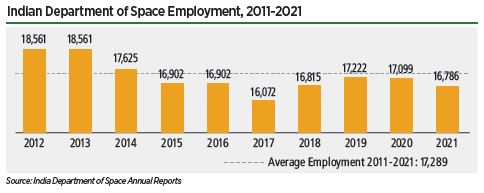

Indian Department of Space Employment, 2011-2021

India’s Department of Space had 16,786 employees as of October 2021, a decrease of 1.8% from the previous year. India’s Department of Space had 16,786 employees as of October 2021, a decrease of 1.8% from the previous year. About 75% of the workforce is composed of science and technology workers, while the remainder focus on administration.

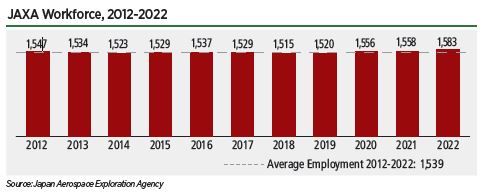

JAXA Workforce, 2012-2022

The Japan Aerospace Exploration Agency (JAXA) employed 1,583 people at the end of 2021, an increase of 1.6% from 1,558 employees at the end of 2020. Approximately 70% of JAXA employees work in engineering and research, with the remainder focused on education and administration. JAXA does not face the same demographic challenges as some other space agencies: 22.0% of its workforce is under 35 years old and 17.9% is over 54.