France

Nation in Review: France

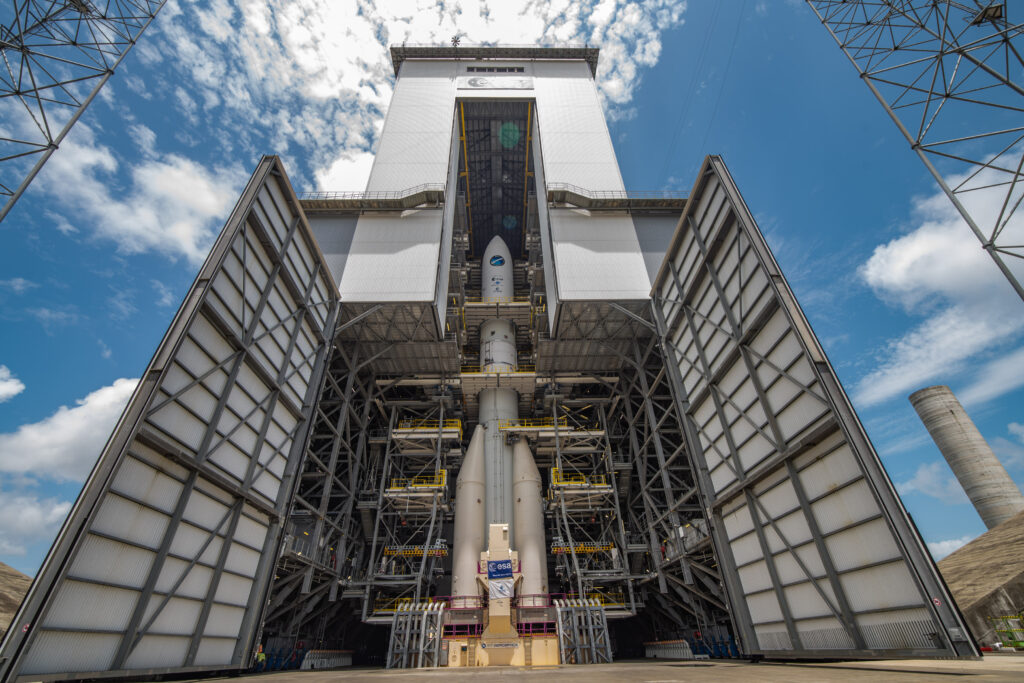

France has always been a pioneer in space: It was the third nation to establish a space program, and it led Europe’s launch vehicle development. Military and civil space strategies from the past few years have planned for the completion of new military satellite constellations, the first launch of the new Ariane 6 launch vehicle, and an increase in domestic space industry investment.

The S-Network Space Index℠ 2022 Performance

The S-Network Space Index℠ tracks a global portfolio of publicly traded companies that are active in space-related businesses such as satellite-based telecommunications; transmission of television and radio content via satellite . . .

Pressure Ramps Up for New Vehicle Launches Pushed from 2022 to 2023

The list of launch vehicles set for maiden flights in 2023 may sound familiar. It’s mostly the same group of launch vehicles initially slated to fly in 2022.

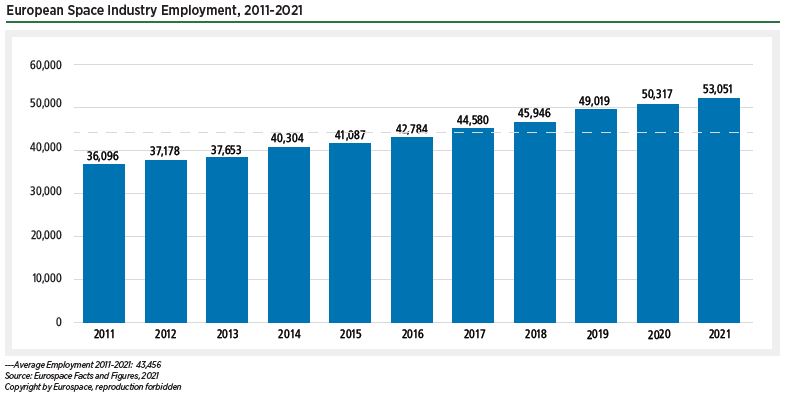

European Space Industry Employment, 2011-2021

European space employment was 53,051 in 2021, an increase of 5.4% from the total of 50,317 from 2020. This estimate is based on analysis by Eurospace, the trade association of the European Space Industry. The analysis focuses on the space manufacturing industry; space services companies such as Ariane- space, SES, Eutelsat, and Inmarsat which also employ thousands of individuals, are not included.

Europe Continues to Lead in Global Workforce Job Growth

The space industry relies on skilled individuals from a wide variety of fields to enable the cutting-edge developments taking place in this sector. While many countries do not regularly produce metrics on the size of their workforce, these data are available for several major space actors, including the United States, Europe, Japan, and India.

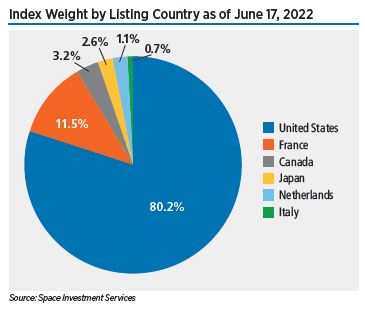

Index Weight by Listing Country as of June 17, 2022

As of June, U.S.-listed companies comprised 80.2% of the weight of the overall index, with France in second place at 11.4%, Japan at 3.2%, Canada at 2.3%, the Netherlands at 2.1%, and Italy at 0.7%. Germany was no longer represented due to the removal of Mynaric.

The S-Network Space Index℠ First Half 2022 Performance

The S-Network Space Index℠ tracks a global portfolio of publicly traded companies that are active in space-related businesses such as . . .

2022 Sets Record for Launch Success Through June 30 Amid Busy Commercial Payload Pace

The first six months of 2022 saw a record pace of space launches, matching the mark of 75 set in the first half of 1967. And through June 30, the year saw a record pace for successful launches, topping the mark of 70 set in 1984.

Government Space Spending Increases 19% from 2020 to 2021

Total government space spending in 2021 reached $107 billion, a 19% increase from 2020, based on Space Foundation analysis. Space Foundation examined government space spending of 46 nations, including 14 nations new to the analysis this year.

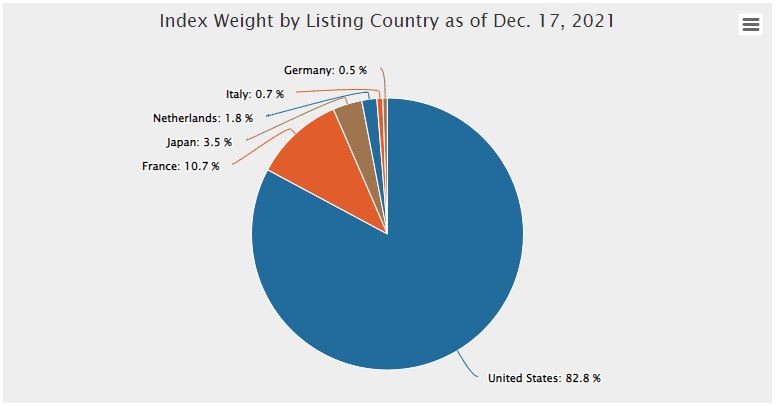

Index Weight by Listing Country as of Dec. 17, 2021

Companies included in the S-Network Space Index in the fourth-quarter 2021 analysis are shown here by national affiliation.