Commercial Infrastructure and Support Industries

Space Insurance

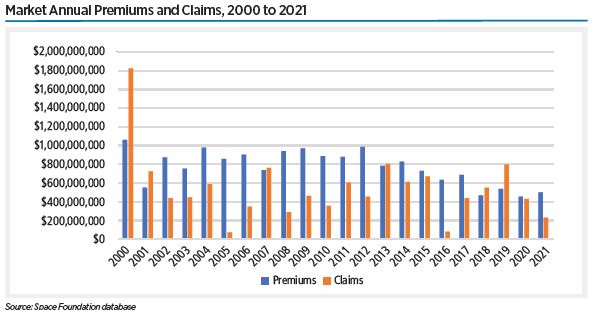

Market Annual Premiums and Claims, 2000 to 2021

2017 – Space Insurance – Snapshot

Satellite and launch insurance allows the private sector to manage some of the risk involved in launching and operating satellites, including launch anomalies and damage caused by space weather, debris, or other events in orbit. In 2017, approximately . . .

2016 – Space Insurance – Snapshot

Space insurance premiums in 2016 amounted to $## million, their ## level since 2001. The year’s claims, including both launch failures and incidents involving satellites in…

2015 – Space Insurance

Infrastructure support industries include activities that do not directly involve development or use of space assets, but are necessary to the smooth operation and advancement of the industry. This category includes space insurance and privately funded research and development. Space premiums in 2015 amounted to $726.6 million, their lowest level since 2001. Seven events, including both launch failures and incidents involving satellites in orbit, led to market losses of $664.3 million, resulting in $62.2 million in profits. This is a significant decrease from the $222.5 million in profits in 2014, but an increase from the $23.3 million in losses in 2013

2014 – Space Insurance

Infrastructure support industries include services such as space insurance and space-related research and development. The global space insurance industry saw continued profitability in 2014, although not to the same extent as in recent years. Space insurance premiums at the end of 2014 were estimated to total $## million, against which $## million in claims were filed. The countries with the greatest number of launches were also the ones who faced a few costly accidents. The Antares launch failure and destruction of its Cygnus capsule was said to cost only about $## million in insurance losses.

2013 – Space Insurance

Infrastructure support industries include services such as space insurance and space-related research and development funded by private organizations. The global space insurance industry saw continued profitability in 2013. Aon ISB, a risk management and insurance brokerage firm, estimated that space insurance premiums at the end of 2013 totaled approximately $## million compared to approximately $## million paid out in claims during the same period, including an estimate of $## million for an expected claim on Koreasat-5.

2012 – Space Insurance

XL Insurance, an insurance brokerage, reported that space insurance premiums in 2012 totaled approximately $## million, compared to approximately $## million paid out in claims. This is comparable to Aon/ISB’s estimates of approximately $## million collected in premiums and $## million paid out in claims in 2011.

Economy: Space Economy – TSR 2012

2011 – Space Insurance – Snapshot

The satellite insurance industry saw profits decline in 2011 but the industry was still profitable, continuing a decade of strong performance. Aon/ ISB, an insurance brokerage, reported that the space insurance industry in 2011 collected premiums totaling approximately $## million while spending totaled $## million on claims.

2009 – Space Insurance – Snapshot

The satellite insurance industry saw profits decline in 2009 compared to 2008. XL Insurance, a space industry specialist, estimates that 2009 premiums totaled $## million, while 2009 insurance claims totaled $## million. Aon/ISB, an insurance brokerage, reported that 2009 premiums totaled approximately $## million and claims amounted to $## million. These estimates indicate that 2009 was a slightly more challenging year than 2008, when XL Insurance reported premiums of $## million, against $## million in claims.