2021

Launch Failure Rate 2019-2023

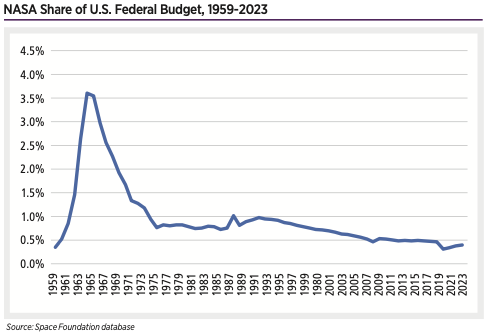

The frenetic pace of launch in 2023 also brought a higher number of launch failures, with 11 rockets failing to make orbit, of them in spectacular fashion.

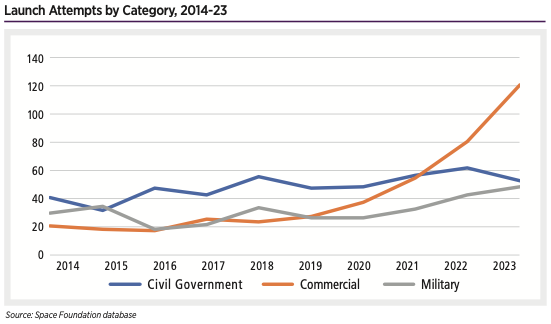

Launch Attempts by Category, 2014-2023

Commercial launches represented 54% of all 2023 launches. Over the past decade, the number of commercial launches has seen a six-fold increase while military and civil government missions have stayed comparatively flat.

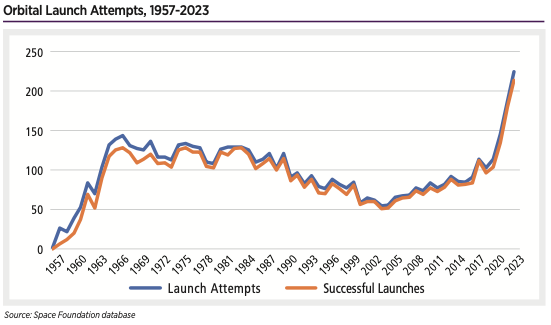

Orbital Launch Attempts, 1957-2023

The number of U.S. launch at- tempts climbed from 87 in 2022 to 116 last year. The number of U.S. launches has more than doubled since 2021, which saw 51 launch attempts.

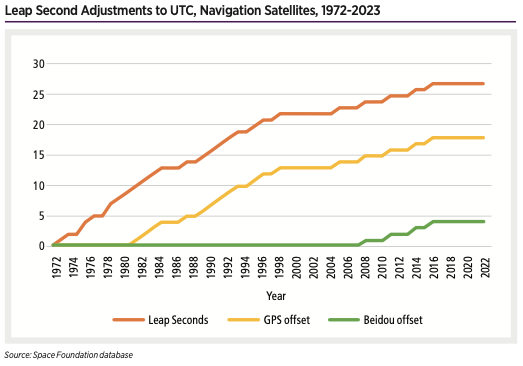

Leap Second Adjustments to UTC, Navigation Satellites, 1972-2023

But every technological leap in clock accuracy can’t overcome the wobbly planet’s ability to throw off timing standards. Using leap seconds, the International Bureau of Weights and Measures has changed clocks to match the astronomical time on Earth 27 times.

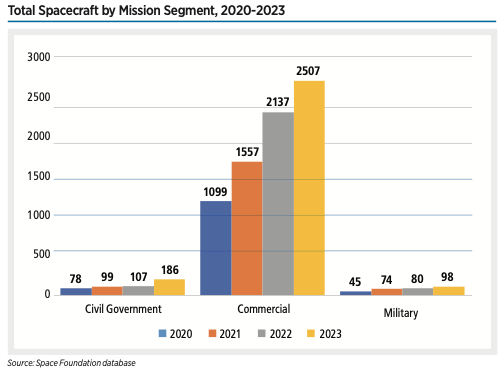

Total Spacecraft by Mission Segment, 2020-2023

The number of satellites in all three mission segments grew by double digits in 2023, with civil government payloads growing most rapidly (74% year-over-year). Over the past four years, the size of all mission segments has more than doubled. Commercial payloads once again made up the largest proportion of deployments in 2023 thanks to mega-constellations such as Starlink.

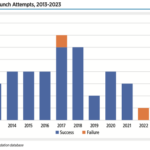

Japanese Launch Attempts, 2013-2023

One problem area for Japan is the possibility of a gap in reliable access to space. The nation is one of 10 capable of orbital launch, but its launch activity is relativity infrequent.

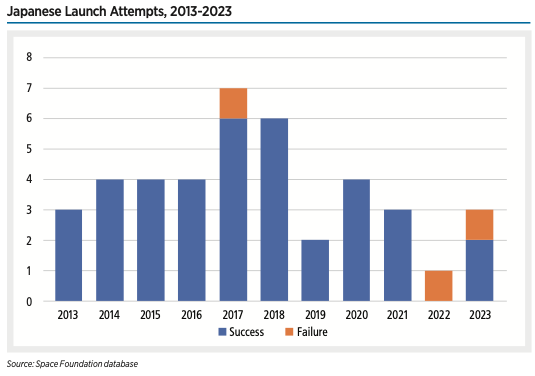

Japanese Workforce by Sector, 2005-2021

JAXA employed 1,580 individuals at the beginning of 2023. Out of this total, 1,123 (71%) are engineering and research employees. Even though Japan as a whole is struggling with an aging population, JAXA’s age demographics are more normally distributed than many other nation’s space agencies.

University Nanosatellite Launches Skyrocket Over Past Decade

Universities across the globe are building an increasingly large presence in space by attaching student satellite projects to launches. Since the advent of nanosatellites and CubeSats, the barrier to space entry has never been lower for students.

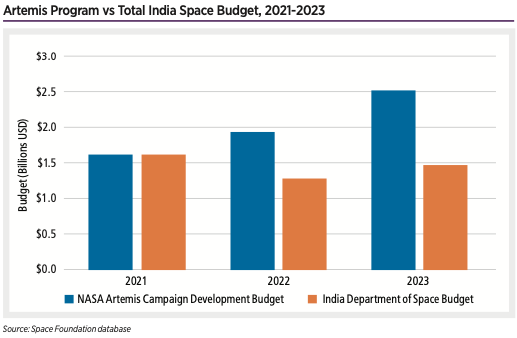

Artemis Program vs Total India Space Budget, 2021-2023

In 2014, four space startups existed in India. In less than a decade, that number increased to 142, according to Goswami.