Appendix

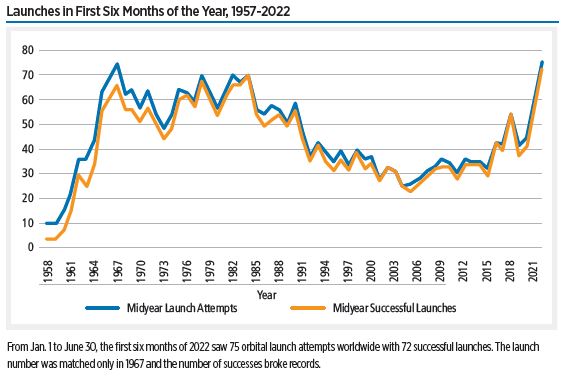

Launches in First Six Months of the Year, 1957-2022

From Jan. 1 to June 30, the first six months of 2022 saw 75 orbital launch attempts worldwide with 72 successful launches. The launch number was matched only in 1967 and the number of successes broke records.

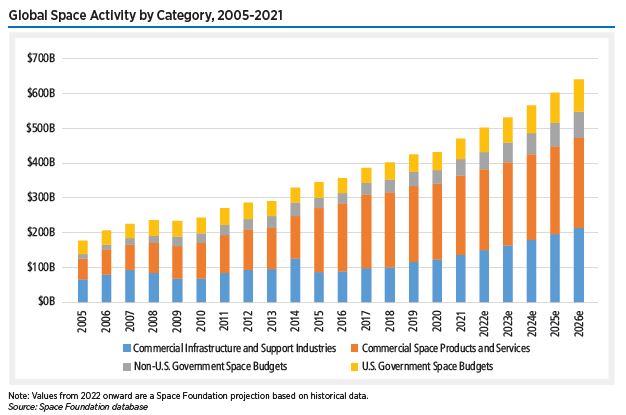

Global Space Activity by Category, 2005-2021

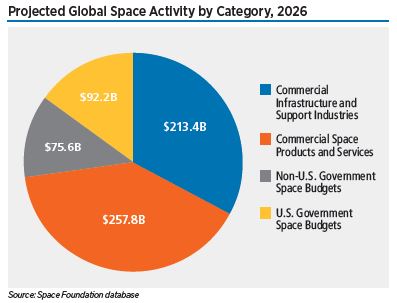

For this year’s analysis, Space Foundation incorporated historical data and 2022 government spending to project the global space economy’s growth over the next five years. Using our methodology, we predict that the total could reach $639 billion by 2026. Our modeling takes a more conservative approach based on average growth of established sectors and does not factor in developing sectors such as lunar habitation or still exploratory concepts such as asteroid mining.

Projected Global Space Activity by Category, 2026

While LEO remains an integral part of the global space economy, interest in cislunar and deep space exploration is growing. Japan, Russia, and the United Arab Emirates (UAE) all have plans to launch lunar landers in 2022, while India’s lunar mission will likely launch in 2023. Many space agencies have set their sights on returning humans to the Moon.

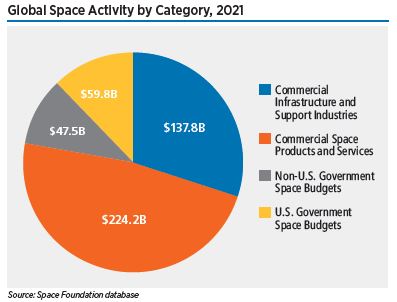

Global Space Activity by Category, 2021

Commercial revenues continued to make up a majority – 77% – of the space economy. This proportion has declined from a previous five-year average of 79%. Commercial infrastructure and support industries remained the smaller of the two subcategories but widened its share of commercial revenues from 35% in 2019 to 38% in 2021.

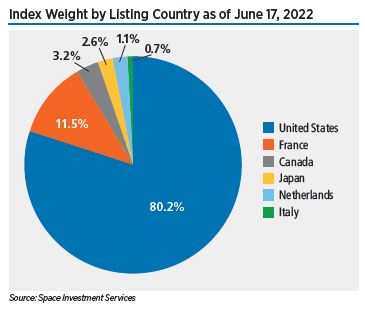

Index Weight by Listing Country as of June 17, 2022

As of June, U.S.-listed companies comprised 80.2% of the weight of the overall index, with France in second place at 11.4%, Japan at 3.2%, Canada at 2.3%, the Netherlands at 2.1%, and Italy at 0.7%. Germany was no longer represented due to the removal of Mynaric.

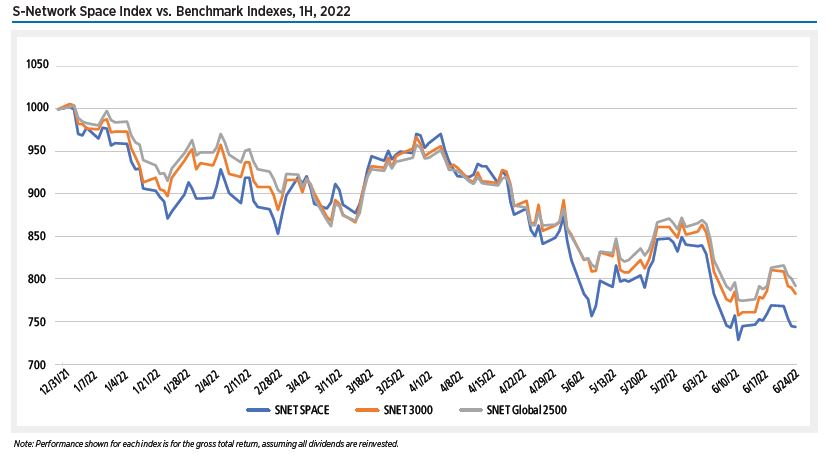

S-Network Space Index vs. Benchmark Indexes, 1H, 2022

In the first half of 2022, the S-Network Space Index (SNET SPACE) underperformed other benchmark indexes, declining 25.6%. This compares to a 21.7% decrease for the S-Network U.S. Equity 3000 Index (SNET 3000), which tracks the 3,000 largest (by market capitalization) U.S. stocks. Similarly, there was a 20.8% decrease for the S-Network Global 2500 Index (SNET Global 2500), which tracks a combination of the 1,000 largest U.S. stocks, 500 largest European stocks, 500 largest Pacific basin stocks (developed), and the 500 largest liquid Emerging Market stocks.

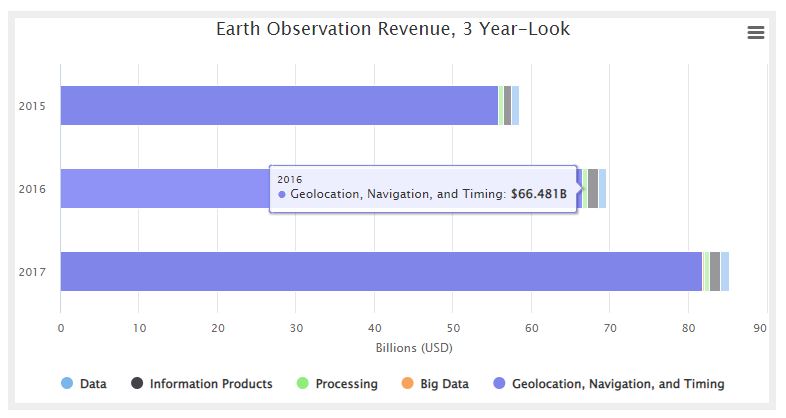

Earth Observation Revenue, 3 Year-Look

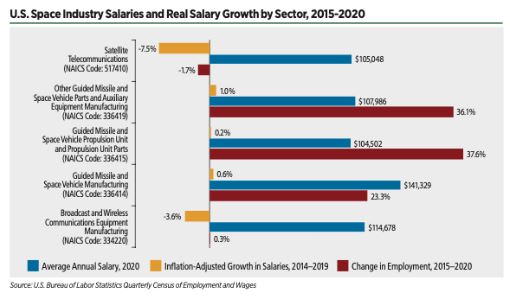

U.S. Space Industry Salaries and Real Salary Growth by Sector, 2015-2020

Space sector categories associated with space vehicle manufacturing all experienced growth in real wages from 2015 to 2020. Combined with increased hiring, this suggests that there is a high demand for individuals in these positions.

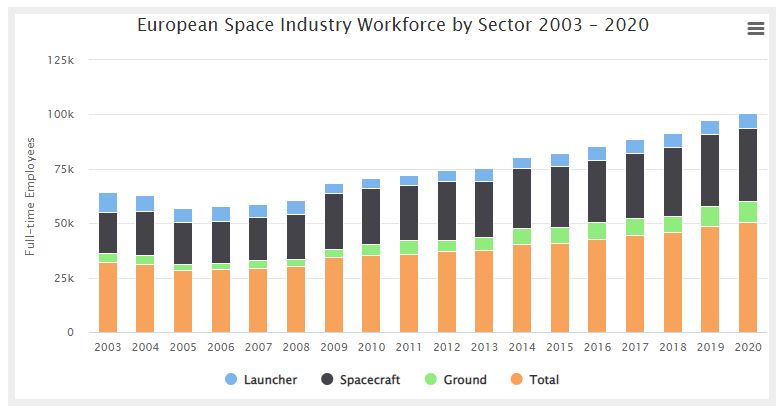

European Space Industry Workforce by Sector 2003 – 2020

European space industry workforce by sector; launchers, spacecraft, and ground for 2003 through 2020.

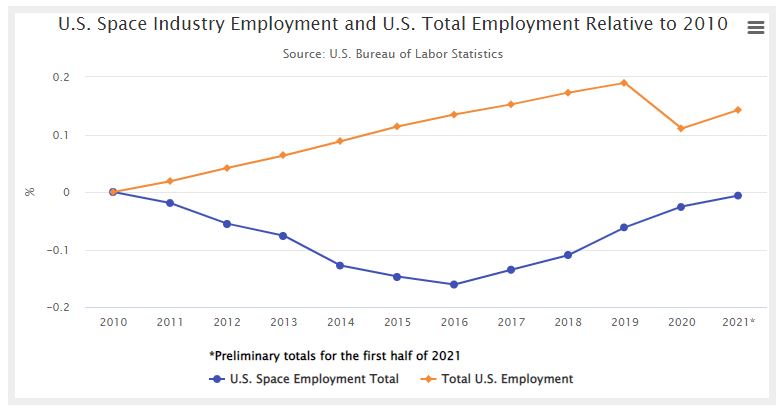

U.S. Space Industry Employment and U.S. Total Employment Relative to 2010

Estimates of the size of the U.S. space workforce are based on statistics made available in the U.S. Bureau of Labor Statistics (BLS) Quarterly Census of Employment and Wages. This program covers 95% of U.S. jobs and provides a consistent and reliable source of information to compare changes in the workforce over time.